GST and QST Calculation in Quebec 2025: Your Complete Guide

Calculating GST and QST is essential for any commercial transaction in Quebec. In 2025, with updated rates and regulations, it’s crucial to understand how these taxes work. In this article, we explore in detail how to calculate these taxes, the current rates, and how to use our calculator to determine the exact amount payable. Whether you’re an entrepreneur, a buyer, or simply someone who wants to understand Quebec’s sales tax system, this article is for you.

Table of Contents:

- What are GST and QST?

- How are taxes calculated in Quebec?

- What are the GST and QST rates in 2025?

- How to use a tax calculator?

- Which products and services are subject to these taxes?

- Are there exemptions for certain sales or purchases?

- Tax calculation for used vehicles in Quebec

- How does tax refund work?

- What is the difference between GST and QST?

- Online sales and GST/QST in Quebec

- How do taxes affect businesses in Quebec?

- What are the major changes in 2025 regarding these taxes?

- First Nations tax calculation (FNGST)

What are GST and QST?

GST (Goods and Services Tax) is a federal tax applied to most goods and services sold in Canada. QST (Quebec Sales Tax) is specific to the province of Quebec. These taxes are collected by sellers at the time of sale and then remitted to the government.

How are taxes calculated in Quebec?

Since January 1, 2013, in Quebec, taxes are calculated by separately adding GST and QST to the initial price of a product or service. For example, if a product costs $100, with GST at 5% and QST at 9.975%, the total cost would be $114.975. Previously, QST was applied on the amount including GST, but this calculation method was changed following a decision in March 2012. For more details, see the 2012-4 information bulletin issued by Quebec Finance.

Example for an amount of $100

GST calculation (5%)

5% of $100

= $100 x 0.05

$5

QST calculation (9.975%)

9.975% of $100

= $100 x 0.09975

$9.975

Total amount after taxes

$100 (initial price)

+ $5 (GST) + $9.975 (QST)

$114.975

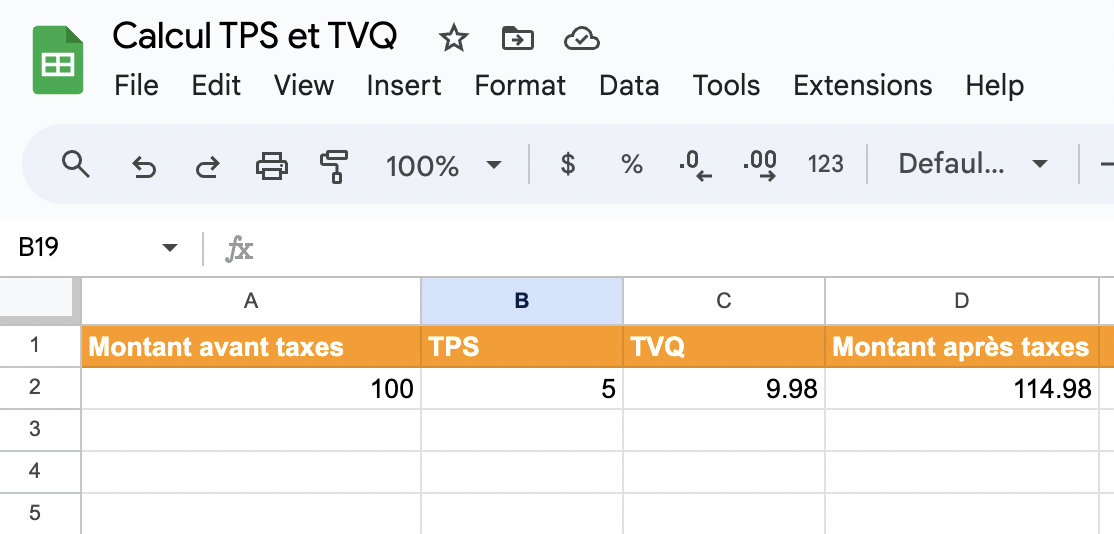

Calculation via Google Sheets or formula with Excel

To calculate Quebec taxes (GST and QST) in Google Sheets, follow the steps below:

- Enter the initial amount in a cell, say A1.

- In the adjacent cell, enter the formula for GST (5%):

=A1*0.05. This will give you the GST amount. - In the next cell, enter the formula for QST (9.975%):

=A1*0.09975. This will give you the QST amount. - Finally, to get the total amount with taxes, you can simply add the initial amount with both taxes.

Note: Be sure to adjust the rates if necessary, as they can change over time.

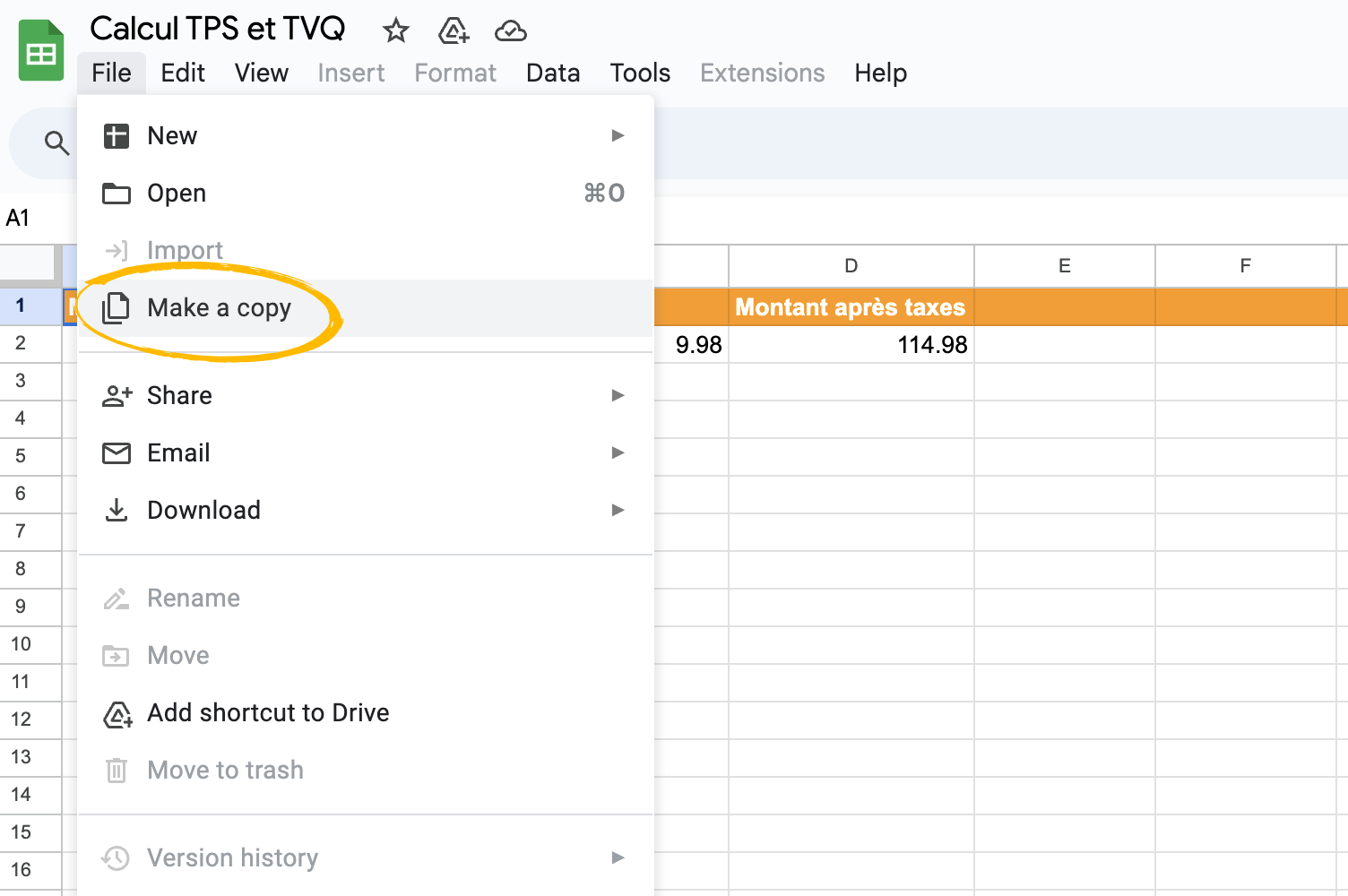

content_copy Use the "File" function > "Create a copy"

- Click File in the top menu.

- Select Create a Copy.

- A new spreadsheet opens with the same content as the original.

- You can edit and save the copy without affecting the original.

What are the GST and QST rates in 2025?

In 2025, the GST rate is 5% and the QST rate is 9.975%. It’s important to regularly check for updates, as these rates may change based on government decisions.

How to use our tax calculator?

If you know the amount before taxes, enter it in the "Amount before taxes" field. The tool will automatically calculate the GST, QST, and the total amount with taxes.

If you know the total amount (including taxes), enter it in the "Amount with taxes" field. The tool will then determine the amount before taxes and the individual GST and QST amounts.

When you enter a value, the results update in real time. Make sure to enter a valid numeric amount for accurate results. It's that simple!

Tax setup for Quebec on WooCommerce

Configure Quebec taxes (GST and QST) on your WooCommerce store in a few simple steps.

Configure your WooCommerce

Which products and services are subject to these taxes?

Most goods and services sold in Quebec are subject to the GST and the QST. However, some basic food products, such as bread and milk, may be exempt.

The tax system in Quebec is based on three categories: taxable supplies (everyday goods and services subject to the GST and the QST), zero-rated supplies (subject to a 0% tax, such as medications and certain food products), and exempt supplies (not subject to the tax, such as health services and the sale of new residential buildings). This classification determines whether a product or service is taxable or not, based on its use and nature.

Are there exemptions for certain sales or purchases?

Yes, certain sales or purchases may be exempt from GST or QST. For example, basic groceries, certain medications, and medical services are generally exempt.

Here are some examples of products exempt from tax in Quebec:

- Food Certain basic groceries, such as bread, milk, and vegetables, are generally exempt from tax.

- Medical and Assistive Devices Devices such as wheelchairs, certain hearing aids, and other essential medical devices may be non-taxable.

- Used Goods Depending on the circumstances, the sale of used goods may be non-taxable.

- Promotional Gifts Items given away for free as part of a promotion may not be subject to tax.

- Gift Cards and Gift Certificates Generally, the sale of gift cards or certificates is not taxed, but goods or services purchased with them may be.

- Free Samples Samples distributed free of charge are not taxable.

- Exports outside Canada (or shipments outside Quebec) Goods exported outside Canada or shipped outside Quebec may be tax-exempt.

- Printed Books Certain printed books may be tax-exempt.

- Drugs and Biological Substances Certain prescription drugs or biological substances intended for human use may be exempt.

- Public Service Bodies Services provided by certain charities or public services may be non-taxable.

- Passenger Transportation in Quebec Certain passenger transportation services, such as some rural bus lines, may be exempt.

- Sales to Indians In certain situations, sales to First Nations members may be exempt from GST/HST.

See the complete list here

Calculating Used Car Taxes in Quebec

If you buy a new or used vehicle from a dealership, you will have to pay both the 5% Goods and Services Tax (GST) and the 9.975% Quebec Sales Tax (QST) on the sale price. You can use our calculator to determine the exact amount.

On the other hand, if you buy a vehicle from a private individual, only the QST is payable, and you will have to pay it to the Société de l'assurance automobile du Québec (SAAQ) when ownership transfers.

How does tax refund work?

Tourists and some businesses can request a refund of GST/HST and QST if they have overpaid taxes. To do this, they must complete the General GST/HST and QST Refund Application (FP-2189). Make sure to keep all necessary receipts and invoices to justify your expenses. Once completed, send the form to the indicated address. The rules and requirements vary depending on the case. Check the details to see if you qualify. The refund may take a few weeks to a few months, so plan ahead to avoid delays.

What is the difference between GST and QST?

The main difference is that GST is a federal tax, while QST is provincial. Also, the rates and application rules may vary.

Online sales and GST/QST in Quebec

In the context of e-commerce in Quebec, online sellers, whether local or foreign, must collect GST and QST on eligible sales. These taxes are determined by the buyer’s place of residence, not the seller’s. Some products are exempt, just like in physical sales.

- Responsibility: Local and foreign sellers

- Tax determination: Based on buyer’s residence

Accommodation taxes for Quebec Airbnb hosts

With the rise of short-term rental platforms like Airbnb, Quebec has introduced specific regulations to ensure tax fairness. The Lodging Tax (TH) is a key measure that all hosts must know and comply with.

Summary of the Lodging Tax (TH):

- Rate: 3.5% of the total booking fees (including service fees)

- Responsibility: Airbnb collects and remits, but the host must declare.

- Registration: Mandatory via form TA12 or online with Revenu Québec.

- Declaration: To be made on form T776 of your tax return.

Summary Table:

| Key Point | Details |

|---|---|

| Collection by Airbnb | Airbnb collects the Lodging Tax on each booking and remits it directly to Revenu Québec. |

| Registration | All hosts must register for the Lodging Tax. |

| Tax Declaration | The Lodging Tax must be declared on form T776. |

| Documentation | Keep all receipts and transaction details to justify your income and expenses. |

| Support | If in doubt, contact Revenu Québec at 1 800 387-1100. |

Practical Tips:

- Make sure your Airbnb account is set up to allow Lodging Tax collection.

- Even if Airbnb collects and remits the tax, keep track of all your transactions.

- Documentation is essential: keep clear records of your income and expenses related to your rental activity.

- Consider consulting an accountant to help you navigate tax complexities.

- By staying informed and proactive, Quebec Airbnb hosts can ensure a smooth rental experience that complies with provincial tax requirements.

What is the difference between the GST and the QST?

The main difference is that the GST is a federal tax, while the QST is provincial. Furthermore, the rates and application rules may vary.

How do taxes affect businesses in Quebec?

Businesses must collect and remit these taxes to the government. They must also keep detailed records of all transactions to ensure they comply with the law.

What are the major changes in 2023 regarding these taxes?

The major change regarding the GST and QST in 2023 is the introduction of a grocery rebate in the 2023 federal budget, to provide Canadians with targeted inflation relief.

However, it is important to note that this measure concerns the GST/HST rebate, not the QST. Furthermore, the GST and QST rates will remain the same in 2023, at 5% and 9.975% respectively.

Financial entities have until July 5, 2023, to file their annual GST/HST and QST information returns.

Finally, GST/HST tax credit payments will be made in July and October 2023 and January and April 2024.

Calculating First Nations Goods and Services Tax (FNGST)

The calculation of First Nations Goods and Services Tax (FNGST) taxes follows a principle similar to that of the GST/HST, applying a rate of 5% to most goods and services supplied on lands administered by eligible First Nations. To calculate the FNGST due on a sale or service, simply apply the rate of 5% to the pre-tax selling price. For example, for a service or good sold for $100, the FNGST to be added would be $5, making the total with tax $105.

Businesses operating on these lands and registered for the GST/HST must charge this tax in addition to their taxable sales made on-site, but they can also claim input tax credits (ITCs) for the FNGST paid on their purchases and expenses, thus simplifying the refund process. This allows for seamless integration into existing tax returns, where the FNGST collected and applicable ITCs are included in the calculation of the net tax due or refund receivable.

Unlike the GST/HST refund, where all registered Canadian businesses are eligible for a refund, the FNGST is exclusively for entities operating on reserves in Quebec. To apply, businesses must complete a specific FNGST application form.

History of QST

QST introduced by the Liberal government of Robert Bourassa. Rate of 8% for goods and 4% for services.

André Bourbeau replaces the two-rate system with a single rate of 6.5%.

QST rate increased to 7.5%.

QST rate increased to 8.5%.

QST rate increased to 9.5%.

QST standardized at 9.975% and no longer applied on the amount including GST.

Grocery rebate introduced in the federal budget to ease inflation.

Conclusion

Whether you are an established entrepreneur, a newcomer to online business, or simply a consumer wanting to understand your rights and responsibilities, staying informed and using the right tools, like a tax calculator, is an asset.

Ultimately, a thorough understanding of these taxes and their application ensures not only compliance but also confidence in an ever-changing business environment.